Monday, July 31, 2023

July 2023 Reads

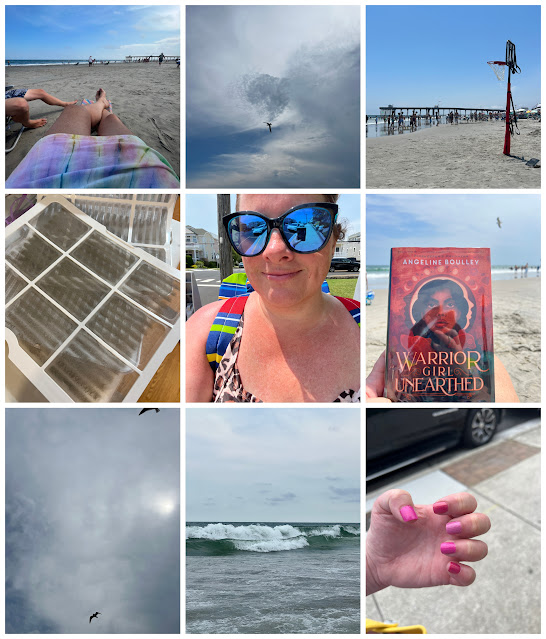

snippets of the weekend 7.31.2023

Thursday, July 27, 2023

snippets of the weekend 7.24.2023

Monday, July 17, 2023

snippets of the weekend 7.17.2023

Monday, July 10, 2023

how to protect your business against chargebacks

Chargebacks allow customers to dispute purchases made using a credit card or debit card so that they can get their money back. When filing a chargeback, customers typically go through their bank or card provider, who then decides whether to reverse the transaction based on any evidence provided.

Chargebacks can protect customers from things like stolen card purchases or unauthorised charges from companies that are otherwise hard to approach. Unfortunately, many customers don’t use them for these noble causes, instead abusing them to get refunds on items without having to contact the seller directly. In some cases, they may even be used fraudulently to get refunds on a product that may claim didn’t arrive (even though it actually did arrive).

For many companies, chargebacks can be a major headache. On top of having to pay back the customer, additional chargeback fees often have to be paid to the card provider, which can make them more expensive than a regular refund. If too many chargebacks are filed against your company, you may even have your account shut down. This is why any company that accepts card payments needs to protect themselves against chargebacks. Below are just a few key ways to do this.

Carefully consider your return and cancellation policy

If a return or cancellation process is too complicated, customers may find it easier to simply resort to a chargeback. While you don’t want to make it too easy for customers to return products or cancel purchases, you should be fair when deciding terms and conditions such as giving customers enough time to return and cancel, and possibly paying for delivery of the returned product. Any return or cancellation forms should meanwhile not be too lengthy, and should be easy to find on your website.

Use a clear billing descriptor

When customers look at their bank statement, they should be able to easily identify each purchase. If the billing descriptor is an old company name or an abbreviation of your company, customers may not recognise it and may file a chargeback claim. Therefore, you should make sure that the billing descriptor is clear as to not cause any confusion.

Choose the right merchant account

Most regular accounts have a low chargeback threshold - meaning that they will shut down if they receive a handful of chargeback claims in a short period. Unfortunately, some industries naturally receive a higher amount of chargebacks such as the gambling industry and the adult industry. If you are running a company within one of these high risk sectors, it is important that you choose a specialist payment processor such as an adult industry payment processor. You will have to pay higher fees on any customer card payments, however you will also be given a high risk merchant account which has a higher chargeback threshold. Such payment processors may also be more willing to contest chargeback claims on your behalf, reducing the amount of successful chargebacks.

Record proof of product receival

Some customers order products online and then deliberately lie about not receiving them in order to get money back through chargebacks. This of course is illegal, but many customers are successful at doing it because there is no hard proof that they received the delivery. Asking couriers to take a photo of products when they are delivered or asking for a signature can provide proof that a product was received, which can help you to fight back against fraudulent chargeback claims.

Provide a high quality product/service

Customers will also file chargeback claims if they are unhappy with a product or service. The best way to prevent these types of chargebacks is to go above and beyond to make each customer satisfied. Don’t settle for a low quality product or poor customer service - not only are you more likely to get negative reviews, but it will leave you open to chargeback claims.

snippets of the weekend 7.10.2023

Friday, July 7, 2023

snippets of the weekend 7.5.2023

And a glorious shot before I left early on Wednesday morning:

.jpg)

.jpg)